Tokenization of Assets: How Blockchain Is Changing Real Estate and Investments

The intersection of blockchain technology and real estate is revolutionizing how we think about property ownership and investment. Asset tokenization, particularly in real estate, represents one of the most promising applications of blockchain technology in the financial sector, offering new opportunities for both investors and property owners.

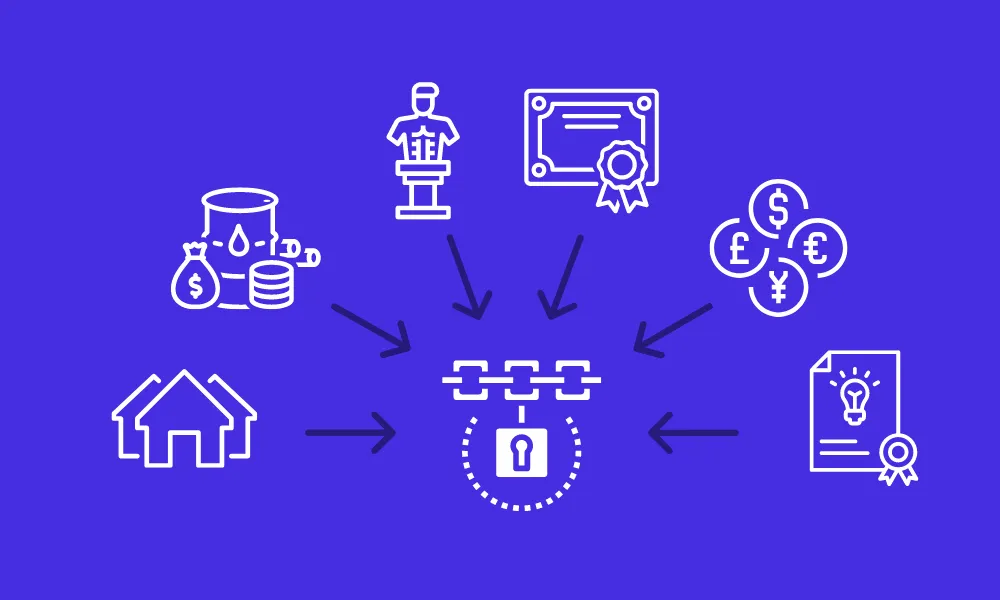

What is Asset Tokenization?

Asset tokenization is the process of converting rights to an asset into a digital token on a blockchain. This innovative approach allows for the digitization of real-world assets, from real estate properties to artwork, creating a more accessible and efficient investment landscape. Through tokenization, traditionally illiquid assets can be divided into smaller, more tradeable units, democratizing access to valuable investments.

The Role of Blockchain in Asset Tokenization

Blockchain technology serves as the foundational infrastructure for asset tokenization, providing an immutable and transparent record of ownership and transactions. The technology's decentralized nature ensures that no single entity controls the system, while smart contracts automate many aspects of asset management and trading.

Smart contracts, self-executing programs stored on the blockchain, facilitate:

Automated dividend distributions

Transparent voting rights management

Seamless transfer of ownership

Real-time settlement of transactions

Benefits of Tokenizing Real Estate

Increased Liquidity

One of the most significant advantages of tokenization is the enhanced liquidity it brings to real estate investments. Traditional real estate transactions often take months to complete, but tokenized properties can be traded as easily as digital assets, subject to regulatory requirements.

Fractional Ownership

Tokenization enables investors to purchase fractional ownership in properties that might otherwise be out of reach. This democratization of real estate investment allows for:

Lower minimum investment requirements

Greater portfolio diversification

Access to premium real estate markets

Global Reach

By removing geographical barriers, tokenization opens up international real estate markets to investors worldwide. This global accessibility creates new opportunities for cross-border investments while reducing the complexity of international real estate transactions.

Impact on Investment Strategies

The emergence of tokenized real estate is reshaping traditional investment strategies. Investors can now:

Create more diversified portfolios with smaller capital outlays

Access previously unavailable market segments

Benefit from reduced transaction costs and faster settlement times

Challenges and Considerations

Regulatory Compliance

The regulatory landscape for tokenized assets continues to evolve. Key considerations include:

Securities regulations

Cross-border transaction rules

Investor protection requirements

Anti-money laundering (AML) compliance

Market Adoption

While the potential benefits are clear, widespread adoption faces several challenges:

Technology education gap

Infrastructure development needs

Integration with existing systems

Market perception and trust

Future Trends and Opportunities

The future of asset tokenization appears promising, with several trends emerging:

Integration with DeFi platforms

Enhanced regulatory frameworks

Improved market infrastructure

Greater institutional adoption

Conclusion

Asset tokenization represents a significant evolution in real estate investment, offering increased accessibility, liquidity, and efficiency. While challenges remain, particularly in regulation and market adoption, the technology's potential to democratize real estate investment makes it an important development for investors and property owners alike. As the market matures and infrastructure develops, tokenization is likely to become an increasingly important part of the real estate investment landscape.